Professional Malpractice Fairness

PROTECTION FOR CONSUMERS

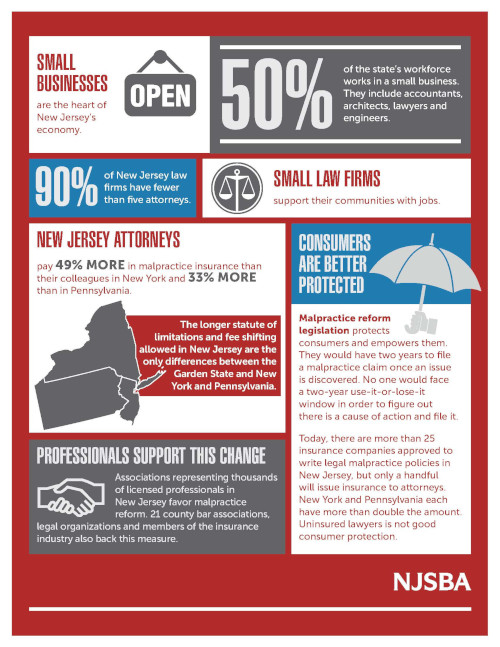

But they often struggle to meet overhead expenses — one of the most costly, but important, is professional liability insurance. The NJSBA continues to advocate for a measure to provide critical stability and predictability to professional malpractice cases, protect consumers and put all professionals on a level playing field.

The measure is supported by representatives from the insurance industry, several county and affinity bar associations and other professional groups that believe it is important to level the playing field the legal community, in particular to young lawyers, solo and small-firm lawyers and those from diverse backgrounds.

Key highlights include:

The time is now for fairness in professional malpractice.

The NJSBA proposal would:

- Provide stability to the cost of doing business;

- Reduce the statute of limitations to bring a malpractice claim against a professional to two years — similar to what it is for doctors and what it is for professionals in New York and Pennsylvania;

- Give consumers two years from the date they reasonably discover a problem to file a malpractice claim;

- Make New Jersey a more competitive place to do business for insurance companies;

- Eliminate fee shifting in legal malpractice claims; and

- Protect citizens by making professional liability insurance more accessible and more affordable to professionals.

Learn more about the New Jersey small business community here.

Read statements from small business owners on the hardships they face due to New Jersey’s restrictive insurance market here.

Read “Professional malpractice stability needed: New Jersey attorneys share their experiences” here. Read “OP-ED: Insurance Bill Would Be Fairer to Professionals, Protect Consumers,” NJ Spotlight here.